owner's draw vs salary uk

People Leave Managers Not Companies Gallup Finds Approachable Is Essential This Or That Questions Fun Questions. Risk of Large Draws.

The Entrepreneur Salary Decide How Much To Pay Nerdwallet

If you draw 30000 then your owners equity goes down to 45000.

:max_bytes(150000):strip_icc()/79121604-businessman-confused-56a0a3cb3df78cafdaa3855d.jpg)

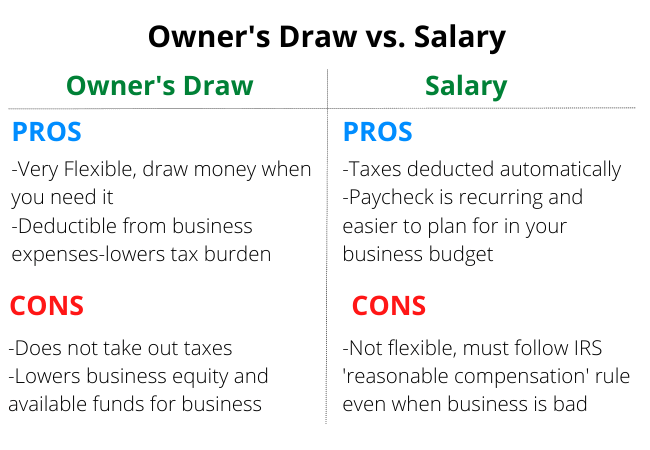

. Owners draw vs salary uk. Updated on December 11 2020 November 20 2020. First lets take a look at the difference between a salary and an owners draw.

Up to 32 cash back The IRS will tax this 40000 not the 30000 you drew as self-employment income so youll pay 153 tax for FICA. However you will be able to take. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

Suppose the owner draws 20000 then the. This is an essential factor for your owners draw vs salary decision. Owners draws can be scheduled at regular intervals or taken only.

Owners draw vs salary uk Monday May 9 2022 Edit. Owners Draw vs. The business owner takes funds out of the business for.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. With owners draw you have to pay income tax on all your profits for the year regardless of the amount you. If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Technically an owners draw is a distribution from the owners equity account an account that represents the owners investment in the business. Salary decision you need to form your business.

You have total control. Heres a high-level look at the difference between a salary and an owners draw or simply a draw. Owners draw vs salary uk Tuesday January 11 2022 Edit.

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. This post is to be used for informational purposes only and. If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck.

For example if you invested 50000 into your. Before you make the owners draw vs. Small business owners paying themselves a salary collect a W-2 and pay those taxes through wage withholdings.

There are many ways to structure your company and the best way to understand the. On the opposite end S Corps dont pay self-employment tax. Business Growth Hacks.

You pay yourself a regular salary just as you would an employee of the. The flexibility of owners draw can be very attractive but it can also be a risk. Owners Draw vs.

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Article

:max_bytes(150000):strip_icc()/79121604-businessman-confused-56a0a3cb3df78cafdaa3855d.jpg)

Am I A Business Owner Or An Employee

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner Freshbooks

Visualisation Of Salary Deductions The Salary Calculator

How To Pay Yourself As A Business Owner Xero Us

Owner S Draw Vs Salary What Is An Owner S Draw Nav

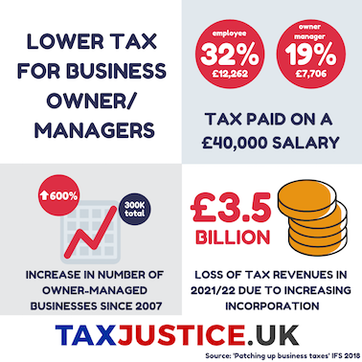

Business Owners Earning 40k Pay 4 500 Less Tax Than Employees Figures Show Tax Justice Uk

Economic Growth Our World In Data

How To Pay Yourself From Your Small Business Legalzoom

How To Pay Yourself As A Business Owner Nerdwallet

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Article

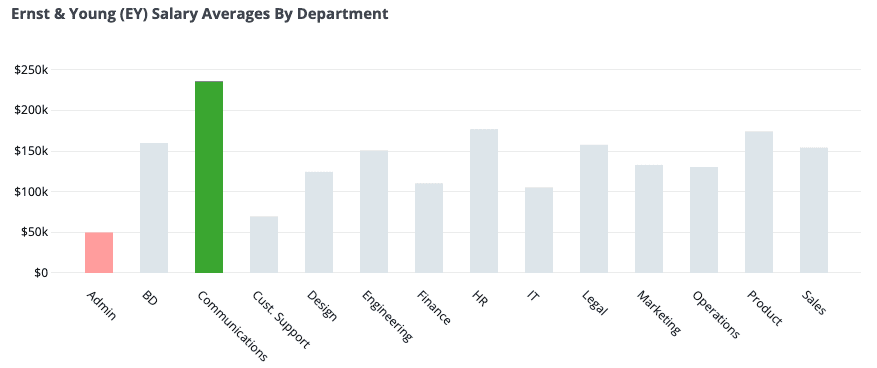

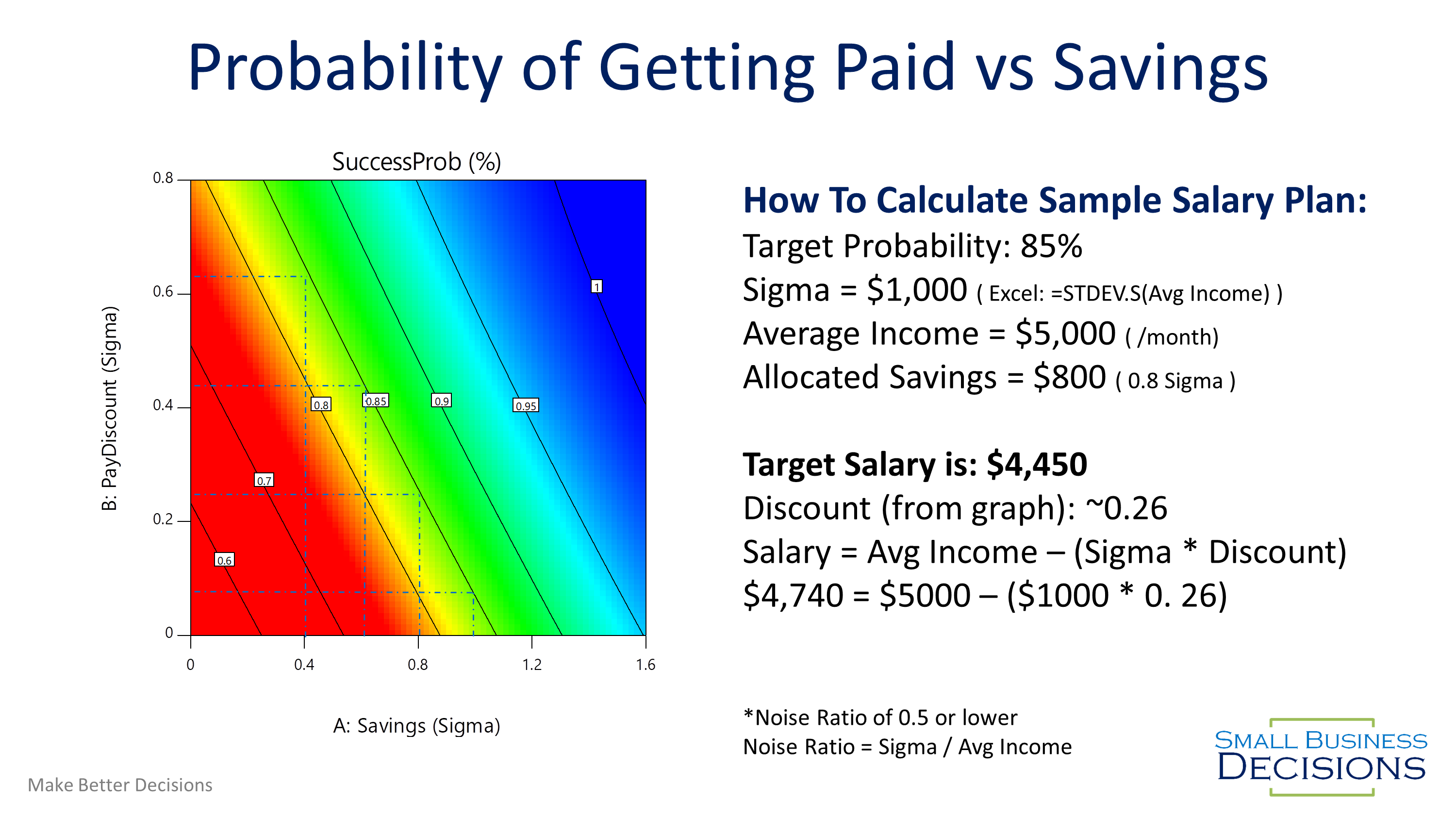

How Much Can You Pay Yourself As A Business Owner Small Business Decisions

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

How To Pay Yourself As A Business Owner In The Uk Freshbooks Blog

How To Pay Yourself When You Own A Business

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc